Over the next week, every owner of real property in Colorado should expect to receive a new Notice of Valuation in the mail from their local county assessor.

Each Notice of Valuation will include an updated valuation for each piece of property, based on property values during the 18-month period from January 1, 2019 through June 30, 2020, with the most important date being June 30, 2020 (the “Assessment Date”). The new valuation will then be used to calculate property taxes for tax years 2021 and 2022, which will then be due in 2022 and 2023, respectively.

General Overview of Property Taxes and Appeals in Colorado

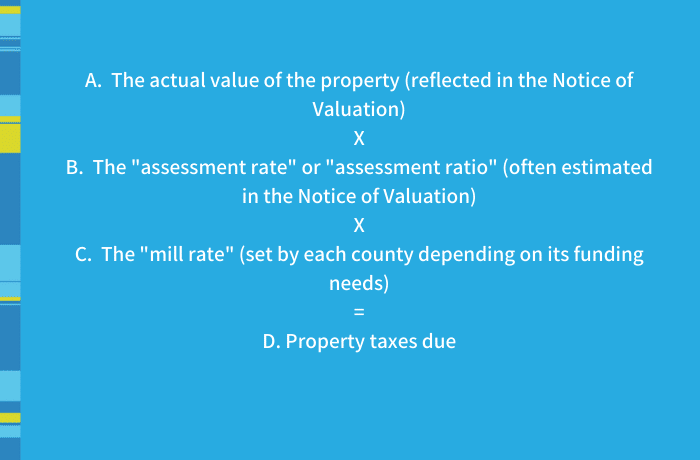

Using the new valuation reflected in the Notice of Valuation, county treasurers calculate property taxes using a formula that multiplies three different input values:

If you believe your property’s valuation or its assigned classification are incorrect, you may want to consider filing a formal objection, called a “protest,” which is due no later than June 1, 2021. If you do not file a protest by June 1, 2021, then your next opportunity to challenge the valuation or classification will be after you pay your taxes, through a “petition for abatement of taxes,” which is essentially a refund request for property taxes that have already been paid. The deadline for filing a petition for abatement of taxes is no later than two years after January 1 of the year such taxes are due. If you do not want to pay excess taxes, however, you should review your Notice of Valuation early and closely to determine whether the valuation and classification are correct.

Effects of the COVID-19 Pandemic

This year, the question on most property owners’ minds is whether the COVID-19 pandemic will affect their property tax bill. In general, it is expected that certain commercial properties will see decreases in values as a result of the pandemic, while other commercial properties will see increases, and residential property values are expected to continue their upward trend, largely unaffected by the pandemic. The properties that are expected to see the greatest decrease in value are single-purpose, high-traffic properties such as hotels, restaurants, or theatres, particularly if business traffic is not expected to recover fully in the foreseeable future.

Keep in mind, however, that property values have generally fared better than businesses and their revenue streams. This means the valuation (and the corresponding tax bill) will not decrease if the value of the underlying property was not itself affected by the pandemic – even if the business suffered substantial losses over the last year. Also, given that this cycle’s Assessment Date was June 30, 2020, this means the new valuation will only reflect the effects of the very first few months of the pandemic, but will not reflect recent changes that occurred after the Assessment Date. As a result, it is generally expected that only a small number of owners will be able to show that the pandemic hurt their property values to such a degree that it would result in a lower tax bill.

If you believe your property values did experience an observable decrease by June 30, 2020, however, it is possible you may be able to submit a protest to ask your Assessor to assign a lower value for tax purposes. If you would like assistance reviewing your Notice of Valuation and any other information that may affect the value of your property, you should consult your Ireland Stapleton attorney to determine whether you would like to submit a protest to your county Assessor. As indicated above, all protests are due June 1, 2021, so time is of the essence.

The information provided herein is intended as general information and is not to be construed as legal advice. If legal advice is needed, you should consult an attorney.