Recently estate planning attorney Thomas J. Wolf spoke to multiple sclerosis patients and their families as part of the Rocky Mountain MS Center’s Education Empower MS Educational Series on the basics of estate planning in Colorado. In his remarks, Tom explained many of the terms used in estate planning and why it is important to think about these topics early on and to discuss them with your family. Below are a few of the questions and the answers from this presentation.

The information provided here is for general purposes only and is not to be taken as legal advice. If legal advice is needed, we strongly encourage you to consult your attorney.

Q: What happens to my estate if I die without a will in place, will the government take my money?

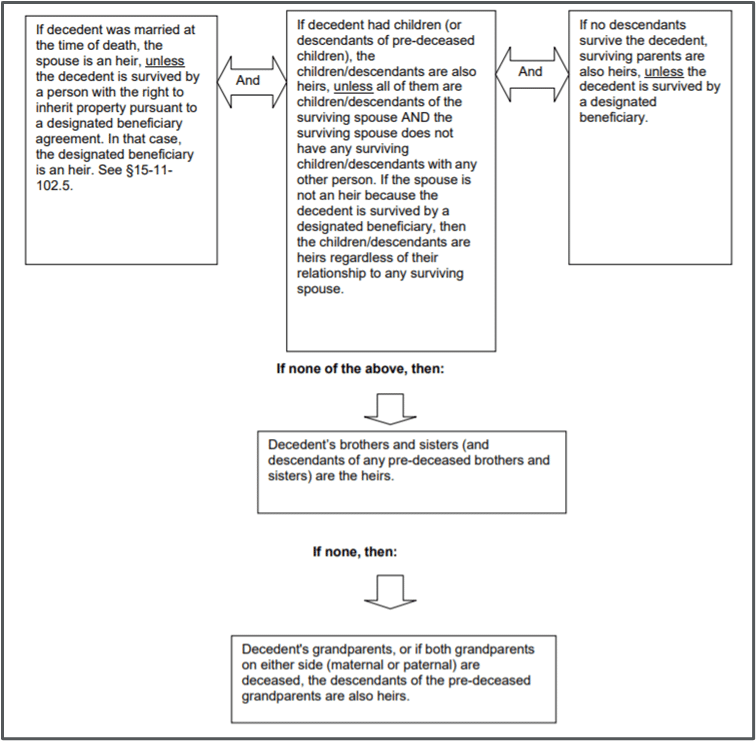

A: The state never gets your estate. The government is never allowed to just take your money. Probate officials go to great lengths to uncover your heirs and make sure your assets stay within the family.

Q: When should you have a trust?

When should you consider a trust over a general will?

Do you recommend a trust? Living trust? Land trust? What’s the difference between them all?

A: First, understand that a trust is a document for real or personal property, and it gives a trustee the power to manage assets for the benefit of a third person, the beneficiary. Generally, the beneficiary gets distributions from interest and dividends on the trust assets during the time of the trust. A trustee is a: person or institution that oversees and manages a trust (https://www.courts.state.co.us/Forms/SubCategory.cfm?Category=Trusts and https://www.courts.state.co.us/userfiles/file/Self_Help/GLOSSARY%20PROBATE%2010-11.pdf). One should first evaluate if a trust is needed. While everyone will have different circumstances when evaluating whether or not a trust is beneficial, we typically don’t see trusts used a lot in Colorado. Most objectives can be managed through your will and a power of attorney.

Q: Can you address the pros and cons of setting up a trust versus adding names as joint ownership, payable on death, or leaving assets in a will?

A: In Colorado, it is often easier to have joint accounts to manage finances. Powers of attorney can also manage an estate. Wills can also be used to help personal representatives manage finances after a loved one passes, but to use these tools, one must first open a probate in their local county. A trust does not use probate. The trustee manages the assets without the court.

Q: Does an estate plan need to be structured differently if assets are held in more than one state?

A: In Colorado, I advise my clients to put assets from other states into Colorado LLCs. This way, they don’t have to open probate in other states.

Q: How would you revoke a power of attorney if one changes their mind of losing control of their assets?

A: A written revocation will work and you will need to tell those that have the power of attorney.

Q: Is it beneficial or even necessary to have an attorney prepare estate planning documents rather than doing it yourself through an online service?

A: I don’t mean this to sound self-serving, but I always recommend using an attorney to help you with estate planning. An attorney can talk you through all of the different ways you can set-up your estate so that your wishes are carried out when you have passed and that your loved ones are cared for in the way you intended. An attorney can also explain how your particular situation may or may not require more strategic planning.

It can be difficult and awkward to discuss complicated topics like finance, medical decisions, and death with loved ones. However, there can also be significant benefits in having a transparent conversation about such sensitive subjects. It is important that those you leave behind understand your wishes for your estate. These conversations, though difficult, can give families a sense of relief and comfort in knowing how best to honor the deceased.

Additional information and resources on probate in Colorado can be found on the Colorado Judicial Branch’s website.